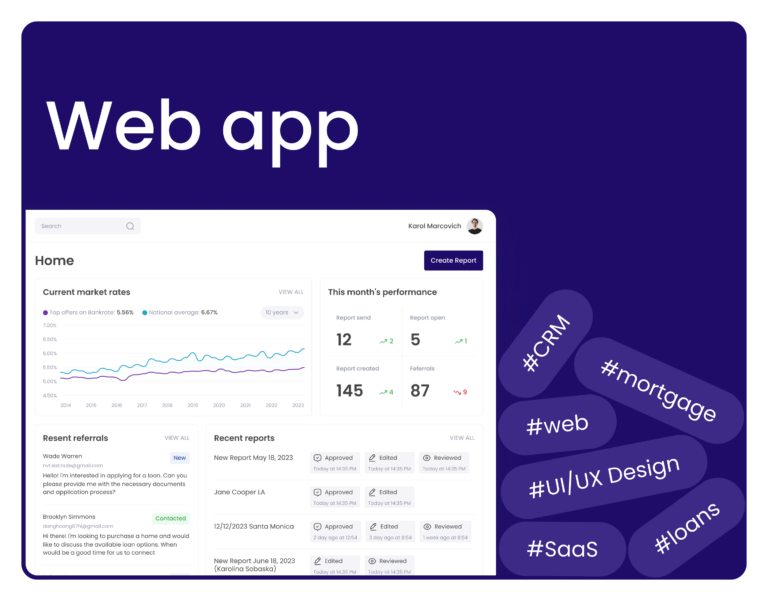

This Agentic Mortgage AI Platform Case Study explores how Bee Techy solved a critical operational bottleneck for a modern mortgage company.

Agentic Mortgage was constrained by a rigid, third-party legacy platform that lacked the control, flexibility, and modern AI features needed for a competitive edge.

Their goal was to replace this outdated system with a sophisticated, custom-built, enterprise-grade platform that could streamline complex mortgage processes and serve as the new heart of their business operations.

Bold Strategy

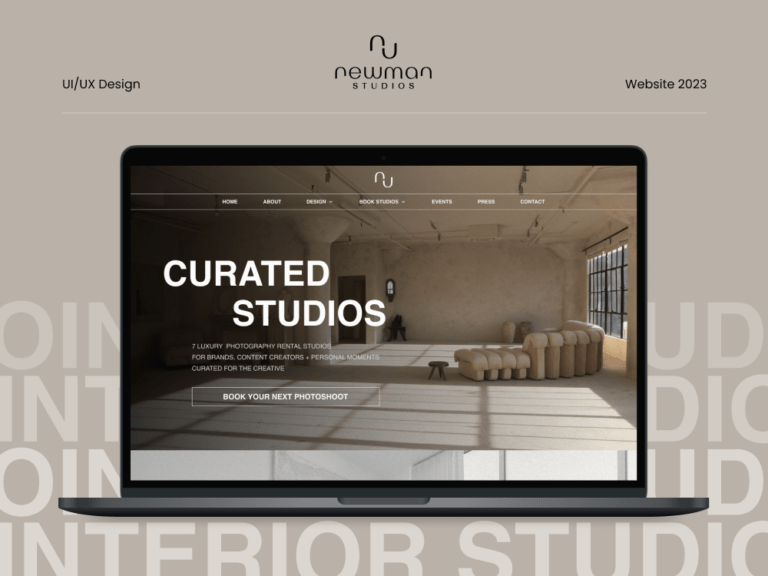

Our strategy began with a Multi-Stage Discovery & Scope Refinement process. We meticulously mapped out requirements by developing detailed User Personas , Customer Journey Maps (CJMs) , and a complete application userflow. This ensured the new, complex platform would be built on a solid, user-centric, and strategic foundation from the ground up.

Enterprise-Grade Execution

We executed a full Enterprise-Grade UI/UX Design phase, creating detailed wireframes and a polished UI Design for the sophisticated interface. This was followed by Agile MVP Development , where our team engineered the complex, AI-powered mortgage platform designed to handle the high-security demands of the financial industry.

Enduring Care & Assistance

The project culminated in the successful delivery of a robust, enterprise-grade mortgage platform. As part of our Enduring Care, the platform is now undergoing its final User Acceptance Testing (UAT) with the client’s team. We are positioned to support them as they leverage the new AI features and roll out the platform as the new heart of their business.